« Billboard Pro : As K-Pop Fandom Grows, Its Touring Biz Is Booming »

Tuesday, August 22, 2023 at 10:34AM |

Tuesday, August 22, 2023 at 10:34AM |  DFSB Kollective

DFSB Kollective

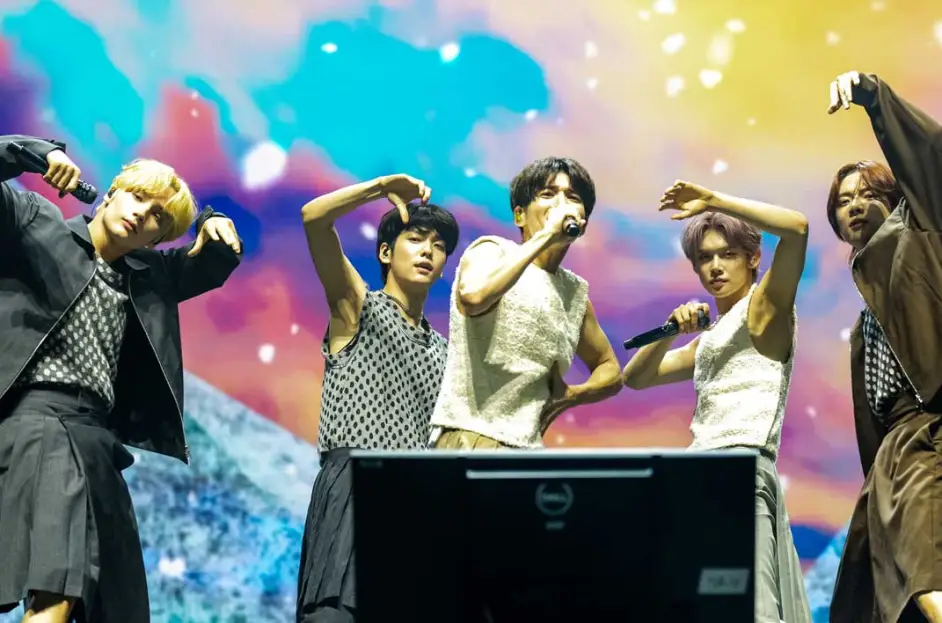

Huening Kai, Soobin, Taehyun, Yeonjun & Beomgyu of Tomorrow X Together @ Lollapalooza [Chicago Grant Park 2023.08.23]. Josh Brasted/FilmMagicA decade ago, the genre was only selling tickets in New York and Los Angeles. Now it's hitting a wide swath of major and secondary markets.

Huening Kai, Soobin, Taehyun, Yeonjun & Beomgyu of Tomorrow X Together @ Lollapalooza [Chicago Grant Park 2023.08.23]. Josh Brasted/FilmMagicA decade ago, the genre was only selling tickets in New York and Los Angeles. Now it's hitting a wide swath of major and secondary markets.

// EXCERPT 1 //

A decade ago, if you wanted to see your favorite K-pop act in concert, you probably had to travel to New York or Los Angeles to catch a rare U.S. appearance. At arena shows and the now-popular KCON festival, acts like BIGBANG and EXO were “doing insane numbers, but they were considered outsiders or outliers,” says Bernie Cho, president of DFSB Kollective, a Seoul-based artist and label services agency. “A lot of these K-Pop tours were dismissed as being extremely niche; but to me K-pop was like the Grateful Dead.”

“It turns out,” adds Cho, “the new Asian market is Caucasian.”

Since BTS broke into the U.S. mainstream in 2017, followed by a wave of other K-pop chart-topping successes from such acts as SuperM, Stray Kids, BLACKPINK, TOMORROW X TOGETHER and, most recently, NewJeans, new touring opportunities are opening up and driving gigs — and business — to more markets across the United States.

// EXCERPT 2 //

K-pop U.S. tour legs are getting longer, too. Whereas they once averaged two to four shows in major markets, tours now average between eight and 12 shows in major and secondary markets, with many artists playing multiple nights in one city. In 2022 and 2023, K-pop artists SUGA/Agust D, TWICE, Stray Kids, SEVENTEEN and TOMORROW X TOGETHER all launched arena and stadium tours that collectively hit such cities as New York, L.A. Atlanta, Seattle, Charlotte, Washington D.C., Houston, Fort Worth, Chicago, Oakland and Toronto. This fall, HYBE act ENHYPEN has scheduled arena gigs in Chicago, Houston, Dallas and Glendale, Ariz., among other cities.

Cho says data analytics tools like Chartmetric — which identifies artists’ streaming, social media and audience data by factors including location, gender, ethnicity and age — have proven especially helpful for artist teams to discover new fanbases while determining routing. He cites a sold-out Epik High show in April at a 3,000-capacity venue in Salt Lake City — typically considered a relatively sleepy B-level market — as an example of such data helping K-pop artists locate fans.

Many Korean labels and management companies are also currently paying to send their emerging acts to the United States in hopes of breaking them here before Asia, given the prestige fostered by making it in North America. “BTS demonstrated that formula,” says Janet Kim, “where they may not have been the biggest artists in Korea when first starting out, but they spent time and money coming to the U.S. and building their fan base and have done very well for themselves.”

While KCON has served as a Stateside launching pad for K-pop acts over the past decade, now their management companies and agents are eying marquee festivals like Coachella, Lollapalooza and Governor’s Ball as crowning crossover achievements. Given that such shows put artists in front of huge crowds, they’re also major opportunities for fanbase development.

// EXCERPT 3 //

It’s a formula that worked for BLACKPINK, who in 2019 became the first K-pop girl group to ever play Coachella. Four years and a global pandemic later, the group headlined the 2023 edition last April. This summer, aespa made history as the first K-pop act to play Governor’s Ball and Outside Lands. After playing Lollapalooza for the first time in 2022, TOMORROW X TOGETHER headlined the festival earlier this month, when NewJeans made its Lollapalooza debut. (This appearance was NewJeans’ first U.S. festival performance, an achievement that happened the same week the group landed its first No. 1 — not to mention its first entry — on the Billboard 200 albums chart with its sophomore EP, Get Up.)

All the sources interviewed for this story said they predict K-pop will continue to grow in the United States. Supporting this, Ellen Kim at Subkulture says that younger fans are more open to non-English content than previous generations, while UTA’s Janet Kim says she’s seen a growing number of labels and A&R executives looking to take on K-pop projects. The HYBE rep says, too, that the many subgenres of K-pop represent pure potential, with these currently “untapped areas” likely to attract even more fans.

https://www.billboard.com/pro

By Katie Bain

Featured Commentator : Bernie Cho [DFSB Kollective]