Illustration by Glenn HarveyWith BTS on hiatus and singles less dependable smashes than albums, Hot 100 domination still eludes many big K-pop acts. But is it even crucial to their success?

Illustration by Glenn HarveyWith BTS on hiatus and singles less dependable smashes than albums, Hot 100 domination still eludes many big K-pop acts. But is it even crucial to their success?

This story is part of Billboard‘s K-Pop Issue.

n March, HYBE founder/chairman Bang Si-hyuk issued a dire warning: “K-pop,” he concluded, “is in crisis.” HYBE is the music company behind BTS, the group that spearheaded K-pop’s dramatic international growth in recent years, but Bang sounded alarmed about the genre’s health. K-pop’s momentum was faltering, he said, claiming fewer tracks from the genre charted on the Billboard Hot 100 in 2022 than in 2021. The following month, BTS’ Jimin released his solo debut album, and the single “Like Crazy” arrived at No. 1 on the Hot 100. Still, his comments dovetailed with general industry anxiety about the dearth of new acts breaking into the mainstream and the challenge of maintaining growth in a ferociously competitive landscape, where around 100,000 new songs hit streaming services daily.

Within K-pop, some executives are concerned about the extent to which the genre can continue to produce massive international hits without BTS’ firepower while the group is on hiatus. “Although I wouldn’t go so far as calling it a ‘crisis,’ I do share [Bang’s] underlying sense of urgency that the Korean music industry is very much at an important crossroads,” says Bernie Cho, president of DFSB Kollective, a Seoul-based artist and label services agency.

K-pop’s ascent to global prominence was, Cho says, “inextricably linked [with] and heavily reliant on the singular artistic visions” of executives at a few key companies — notably SM Entertainment, YG Entertainment and JYP Entertainment. “It has become an open source of debate these days, from boardrooms to chat rooms, that steadfastly sticking to this single-lane approach may no longer be the right direction” if the industry hopes to “futureproof” K-pop.

Executives who work in and around the genre are quick to pinpoint one big reason for the recent lack of K-pop in the upper reaches of the Hot 100: In June 2022, BTS — which has topped the chart four times on its own and twice more as a collaborator with Western artists — announced its potentially yearslong hiatus. “Their vacancy is definitely going to put a bit of a hole in the market,” says Eddie Nam, CEO of EN Management (Eric Nam, Epik High).

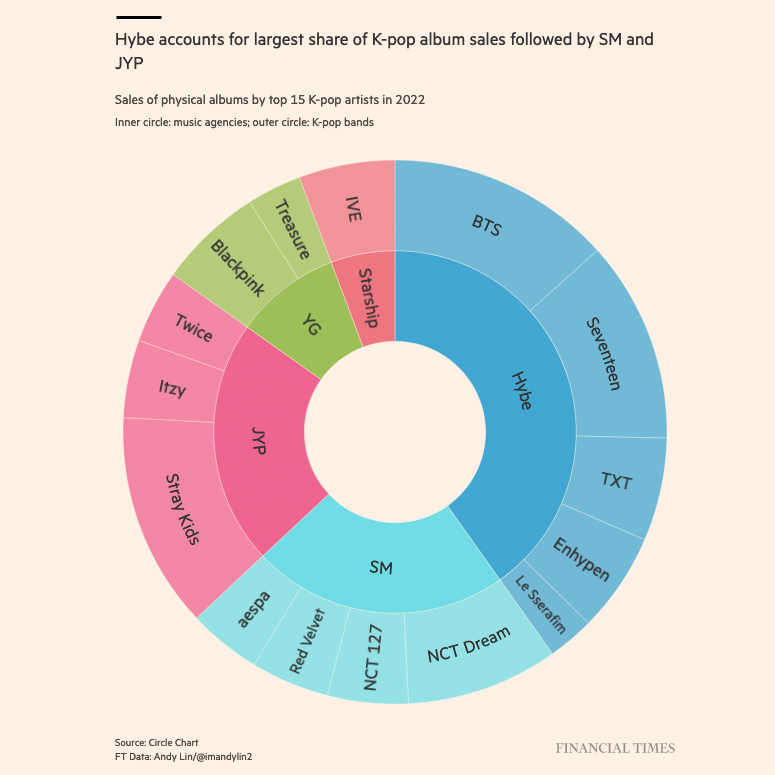

But there’s disagreement on whether hit singles in the United States are the best gauge of the genre’s health in the first place. On the Billboard 200, K-pop albums continue to hit No. 1 thanks to robust physical sales of CD variants; last year, K-pop groups topped the chart four times — Stray Kids twice and BTS and BLACKPINK once each — setting a new high-water mark for K-pop. “Most K-pop groups are built on a strong fan base, and their loyalty and support for their artists is much more organized than in the past,” says YG Entertainment USA’s former president Joojong Joe. “These fandoms know that Billboard chart positioning is important to their artists, and they organize album purchases and promotion within their fandom in the first week of an album’s release in order to get it to the top of the charts.”

But recently, K-pop acts haven’t scaled the same heights on the Hot 100. The biggest recent non-BTS K-pop hit was BLACKPINK’s “Pink Venom” last year, which peaked at No. 22. In the United States, the genre’s singles often perform phenomenally on the downloads chart — mirroring their dominance in physical sales — but less well on the streaming and radio rankings. “Like Crazy,” for example, sold 254,000 downloads, easily topping Digital Song Sales, but clocked in at No. 35 on the Streaming Songs chart. BTS’ previous No. 1, the Coldplay collaboration “My Universe,” also topped Digital Song Sales in its first week but landed at No. 21 on Streaming Songs.

Getting airplay in the United States remains K-pop’s biggest challenge: BTS has spent 17 cumulative weeks atop the Hot 100 but hasn’t made it past No. 5 on Billboard’s Pop Airplay chart, and BLACKPINK hasn’t even cracked the top 20 on Pop Airplay. The airplay audience for “Like Crazy” is the lowest for a Hot 100 No. 1 this decade. “I don’t think we’ve seen Korean music take over U.S. radio in any way,” Nam says. This remains true even as most of the biggest K-pop acts now work with American major labels, which have long-standing radio promo teams.

As Joe points out, K-pop artists aren’t necessarily so different from others outside the United States when it comes to that airplay disadvantage. “You’re in the country for promotion for only a short amount of time,” he explains. “You have to prioritize — you have a late-night show on TV; you have a concert; you have a photo shoot. It takes a lot of time to build relationships at radio, and it has not been easy for Korean artists to do that in the short amount of time they have here.”

In addition, many K-pop singles are only partially in English, which may make them a tougher sell at radio — a medium not known for taking risks. (Bad Bunny is one of the biggest artists in the world, but he has never made it past No. 19 at pop radio as a lead artist.) Three of BTS’ biggest hits were entirely in English; two others were collaborations with prominent Western acts singing in English.

Others, like Michael Martin, senior vp of programming for Audacy, the second-largest radio company in the United States, dismiss the idea that language might be limiting K-pop’s airplay. Representatives for two other prominent radio conglomerates, iHeartRadio and Cumulus, declined to comment on K-pop airplay, though iHeart has been supporting rising acts like NewJeans, especially in cities on the West Coast, and had some of the few stations that played “Like Crazy” during its debut week.

However, there’s also an argument that in an increasingly global music marketplace, hits are no longer the most important indicator of a genre’s health — and that K-pop’s difficulty getting U.S. radio play ultimately doesn’t matter to its momentum. “I don’t think K-pop groups must have hit singles in the U.S. to succeed globally,” says Inkyu Kang, an associate professor at Penn State and the author of K-Pop: The International Rise of the Korean Music Industry. “K-pop had already been enjoyed by people around the world with diverse backgrounds before it reached the U.S.”

Those listeners continue to seek out music from the genre: K-pop groups accounted for four of the top 10 albums in the world last year, according to the most recent report from IFPI, up from two in 2020. Looking just at sales rather than overall consumption, K-pop acts have a whopping eight out of the top 10, up from four in 2020. “Last year, the K-pop industry had the highest album sales overseas in history,” though growth in album sales slowed significantly, says Stephanie Choi of SUNY Buffalo’s Asia Research Institute, who is working on a book on K-pop. Japan, China and the United States were the three biggest importers of K-pop albums.

“You have to look at the whole pie,” says Lucas Keller, who manages Jenna Andrews, co-writer of BTS’ runaway hit “Butter.” “K-pop has one of the most committed fan bases in the history of music. You have to look at the touring, the merchandise and the audience, not just the charts.”

“When I speak to folks in the industry,” Keller adds, “we all believe that Korean pop acts have a real seat at the table now — including a shot at Western success in a way that was more difficult in past years.”

This story originally appeared in the April 22, 2023, issue of Billboard.

https://www.billboard.com/music/features

By Elias Leight

Featured Commentator : Bernie Cho [DFSB Kollective]

Monday, April 24, 2023 at 12:34PM |

Monday, April 24, 2023 at 12:34PM |  DFSB Kollective

DFSB Kollective